How it works

Doppler makes token creation and liquidity simple, transparent, and effortless—so anyone can launch, price, and grow markets without the noise.

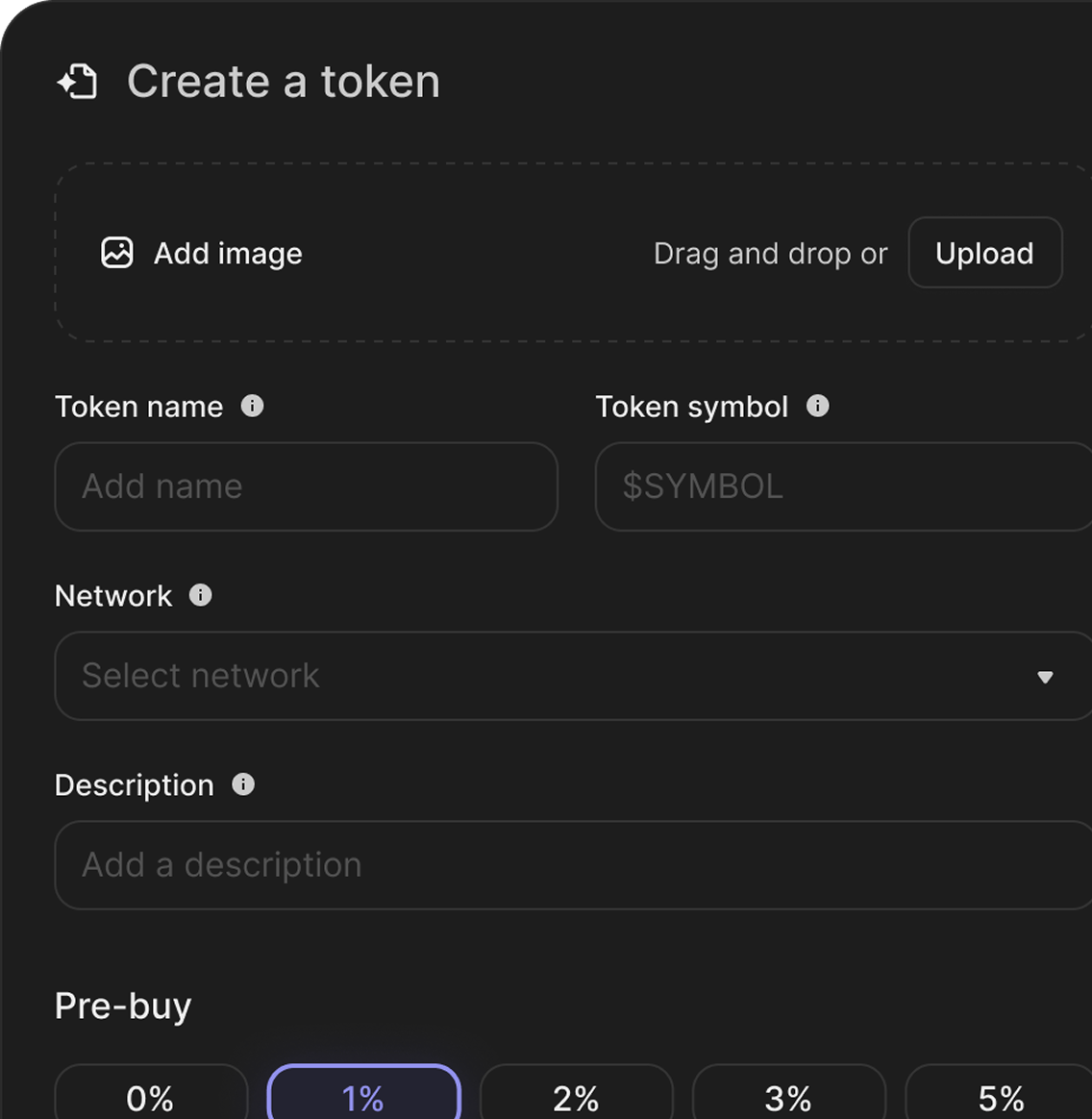

Create any token

Define and deploy any tokenized asset without limitations. From memecoins, to RWAs, and protocol tokens, you are in the driver's seat.

Find market prices

Onchain price discovery mechanisms help your assets establish a market value through efficient and transparent smart contract mechanisms.

Boost liquidity

Jumpstart your markets with a vertically integrated, DeFi-native solution. Supporting migration of liquidity to popular DEXs out of the box, like Uniswap.

Build apps, not auctions

Doppler lets developers build unique applications without worrying about market structure, auctions, or smart contracts.

From attention marketplaces to memecoin launchpads to new financial primitives, Doppler's contracts and TypeScript SDK handle the infrastructure, so you can stay focused on your product.

const createV3PoolParams:CreateV3PoolParams= {

integrator: account.address,

userAddress: account.address,

numeraire: weth,

contracts: {

tokenFactory,

governanceFactory,

v3Initializer,

liquidityMigrator,

},

tokenConfig: {

name: tokenName,

symbol: tokenSymbol,

tokenURI: `https://doppler.lol/token/${name}`,

},

vestingConfig: "default",

};Read the whitepapers

Dive deeper into the foundations of how Doppler's custom capital markets work

Doppler

Doppler is a liquidity bootstrapping ecosystem that facilitates liquidity provision by introducing a new primitive that we call a "dutch-auction dynamic bonding curve", which is used to source initial two-sided liquidity.

Read the paper

Multicurve

Instead of a CLAMM placing one constant liquidity position, integrators specify their desired curves, which in itself is entirely managed by Multicurve. Multicurve is compatible with the rest of the Doppler Protocol ecosystem.

Read the paperWhy Doppler

Doppler is the protocol for creating and distributing tokens with fair price discovery, MEV protection, and built-in paths to liquidity and governance. Every feature is modular, onchain, and designed for capital efficiency.

Tokens, instantly

Any app can permissionlessly create tokens by passing inputs into Doppler smart contracts — from memecoins to RWAs to governance tokens.

MEV-resistant launches

Dutch auction bonding curves protect users from sniping bots and chaotic "ape-in" dynamics.

Capital efficient by design

Optimized bonding curves bootstrap liquidity quickly and grow into deep pools over time.

Seamless Uniswap migration

Once liquidity goals are met, tokens and LP positions migrate to Uniswap v2 or v4 automatically, with support for custom fees.

Governance & treasuries

Integrate OpenZeppelin Governor treasuries to give communities shared ownership and decision-making, or skip it entirely.

Composable & programmable

Smart contracts are fully onchain, composable, and modular. Add vesting, airdrops, incentives, DAO tooling, and more.

Dynamic fee routing

Route fees across beneficiary addresses and tiers to align token economics. Track immediate release, community rewards, team vesting, and more.